Sep 12, 2023, Posted by Admin

Income Tax Under Old and New Tax Regime

Income Tax under old and new tax regime

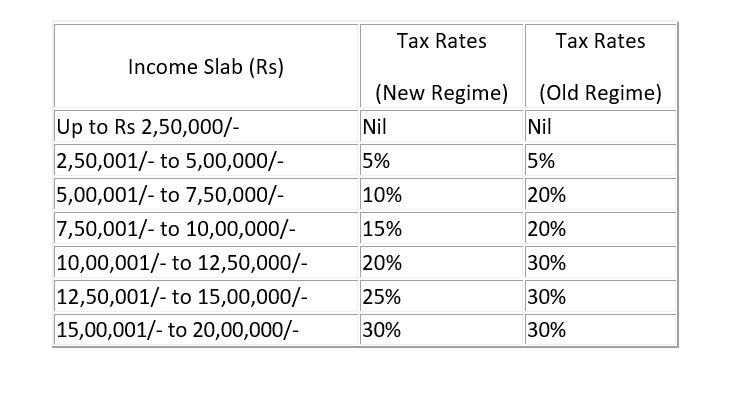

As of my last knowledge update in September 2021, the Indian government introduced a new tax regime in the Finance Act, 2020, which offers lower tax rates but limits or eliminates many deductions and exemptions. However, taxpayers have the option to choose between the old and new tax regimes, depending on their financial situation and preferences.

Here is a general overview of eligible deductions under both regimes:

Old Tax Regime:

Under the old tax regime, taxpayers are eligible for various deductions and exemptions under sections of the Income Tax Act, 1961. Some of the common deductions and exemptions include:

Standard Deduction: A standard deduction of Rs. 50,000 was available for salaried individuals.

Deductions under Section 80C: You could claim deductions of up to Rs. 1.5 lakh under Section 80C for investments in various instruments such as Provident Fund (PF), Public Provident Fund (PPF), National Savings Certificates (NSC), and more.

Deductions under Section 80D: Deductions for health insurance premiums paid for yourself, your family, and your parents were available up to Rs 25000/- under Section 80D.

Deductions under Section 80E: Interest on loans taken for higher education was eligible for deductions under Section E

Deductions under Section 80G: Donations made to eligible charitable institutions and trusts were eligible for deductions under Section G .

Deductions under Section 24(b): You could claim deductions on the interest paid on home loans under Section 24(b).

Section 10(14): Exemption on House Rent Allowance (HRA) for salaried individuals.

Section 10(38): Exemption on long-term capital gains from the sale of listed equity shares and equity-oriented mutual funds (subject to conditions).

Section 80TTA: Deduction for interest income on savings account up to a certain limit.

Section 80TTB: Deductions on Senior Citizens Savings Scheme.

Section 80GGA and 80GGC: Deductions for donations made for scientific research and contributions to political parties.

New Tax Regime

The new tax regime offers lower tax rates but restricts most deductions and exemptions. In the new regime, taxpayers are not eligible for most deductions, including those mentioned above. However, some exemptions like the employer's contribution to the Employee Provident Fund (EPF) and the Employee State Insurance (ESI) are still available.

Some key points about the new tax regime include:

Standard Deduction: Standard deduction of Rs 50,000/-

No Deductions under Section 80C, 80D, 80E ,80CCD(1B) and Others: Under the new regime, you could not claim deductions under Section 80C, 80D, 80G, and various other sections.

No Deductions for Home Loan Interest: You could not claim deductions for home loan interest under Section 24(b) in the new regime.

Limited Deductions for NPS and EPF: Taxpayers can claim deductions under sections 80CCD (2) (employer's contribution to NPS) and the Employees Provident Fund (EPF) were still available in the new regime.

No Deductions for Leave Travel Allowance (LTA): LTA was not eligible for deductions in the new regime.

It is essential to note that taxpayers need to choose between the old and new tax regimes each financial year, depending on their specific financial circumstances and which regime offers them better tax benefits.

INCOME TAX CALCULATION FINANCIAL YEAR 2023-24

Taxpayers are encouraged to consult with a tax advisor which regime is more advantageous for them based on their income sources, investments, and deductions. Tax laws and rules may change over time, so it is important to stay updated with the latest tax regulations and consult a tax professional for personalized advice.

We Jain Anurag & Associates, Chartered Accountants provide end-to-end Tax consultancy services to our clients, you can connect with our expert team to avail the Tax consultancy services.